By Allan Burrows, CapDev CEO

With all the talk regarding inflation and looming recession, what’s a nonprofit to do?

In May of 2022, a Washington Post article stated former Goldman Sachs chief executive Lloyd Blankfein warned of a “very, very high risk” of recession; Wells Fargo CEO Charlie Scharf said there was “no question” that the U.S. economy is heading toward a downturn; and former Fed chair Ben Bernanke cautioned that the country could be poised for “stagflation,” a slowing economy combined with high inflation. A year later, those words still abound in many financial publications.

Given these predictions, how do nonprofits ready themselves to provide critical services and seek philanthropic support when inflationary costs are rising, financial markets are fluctuating and optimism in our economy is waning?

The answer is clear: learn from history.

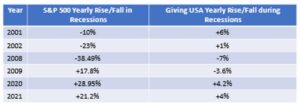

According to research, total charitable giving has increased by over $300 billion between 1979 and 2021. Philanthropy has increased or stayed flat in current dollars every year during this time, except for three years that experienced significant economic declines: 1987, 2008 and 2009.

Charitable giving trends track with the stock market. Giving typically grows during good times and declines during recessions. The difference, however, is that philanthropy is more resilient: it does not have the dramatic spikes and declines as seen in the market. In other words, donors are not “boom or bust,” but rather in it with nonprofits for the long game.

Looking back over the last six U.S. recessions (a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters), let’s compare the rise and fall of the Standard & Poor’s 500 versus Giving USA tracking of philanthropy and see the resiliency in giving:

What lessons can history teach us?

1. Recessions are temporary.

The last three major recessions—early 1990s, early 2000s, and the Great Recession—typically lasted between eight and 18 months, according to the National Bureau of Economic Research. The more recent ones – early 2020s—were much shorter.

Nonprofits should consider how to outlast this temporary economic setback: plan; accordingly, tighten budgets where feasible, utilize reserves appropriately, and seek strategic collaborative partnerships wisely.

2. Donors are long-term.

The last recessions and the recent pandemic proved once again that donors are resilient and want to stay invested with you. Size, timing, and purpose of gifts during recessions must be considered in a nonprofit’s approach to its closest donors. Who knows? Recessions and downturns can even inspire giving, as evidenced by the increased disbursements of Donor Advised Funds during COVID-19!

Nonprofits need to stay “near, dear and clear” to their donors, especially with major donors who’ve continued to provide a substantial amount of philanthropy over the last decade.

3. Campaigns can survive – and thrive – during recessions.

A well-planned and relationship-built campaign can be successful, even during economic slowdowns. In its almost four decades of service, CapDev has seen hundreds of millions of dollars raised (even during the Great Recession!) when clients build a strong case of the importance of its mission, educate and engage a well-cultivated donor audience, invest in a strong campaign infrastructure, and have enlisted a dynamic leadership who give generously and work closely with their peers to give as well.

Nonprofits need to take the time now to properly ready themselves—and their donors—for whatever economic winds blow in the near future. Effectively communicate impact with the monies donors generously give and help them feel that they are “part of the story,” especially when they also often have relationships with those who can also make a difference.

As the bard of baseball Yogi Berra’s says, “Predictions are tough, especially when they are about the future!” No one knows know exactly how or when a possible recession will impact services and support. History tells us that we can, however, be resilient and be ready!

Return to Insights & Events